UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to14a-12under §240.14a-12

Enterprise Bancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

ENTERPRISE BANCORP, INC.

222 MERRIMACK STREET

LOWELL, MASSACHUSETTS 01852

TELEPHONE: (978) 459-9000

March 31, 2016

April 3, 2024

Dear Stockholder:Shareholder:

You are cordially invited to attend the 20162024 Annual Meeting of Stockholders'Shareholders (the “Annual Meeting”) of Enterprise Bancorp, Inc. (the “Company”), the parent holding company of Enterprise Bank and Trust Company, to be held on Tuesday, May 3, 2016, at 3:30 p.m. local time,both by means of remote communication and in person at the UMassEnterprise Bank “Community Room,” 18 Palmer Street, Second Floor, Lowell, Inn and Conference Center, 50 Warren Street, Lowell, Massachusetts.

01852 on Tuesday, May 7, 2024, at 9:00 a.m. local time.

The Annual Meeting has been called for the following purposes:

| |

1. | To elect seven1.To elect the (5) five Directors of the Company named in the Company, each for a three-year term; |

| |

2. | To approve and adopt the Company's 2016 Stock Incentive Plan; |

| |

3. | To vote on the ratification of the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; and

|

| |

4. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

The accompanying Proxy Statement of the Company for the Annual Meeting (the “Proxy Statement”), each to serve for a three-year term expiring at the 2027 annual meeting of shareholders or until their respective successors are duly elected and qualified, or until their earlier resignation, death or removal from office;

2.To conduct a non-binding advisory vote to approve the compensation of the Company's named executive officers (the “Say on Pay Proposal”);

3.To ratify the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

The accompanying Proxy Statement provides information concerning the matters to be voted on at the Annual Meeting. Also enclosed is the Company’s 20152023 Annual Report to Stockholders,Shareholders, which contains additional information and results for the year ended December 31, 2015, including2023, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 as filed with the Securities and Exchange Commission on March 15, 2016.8, 2024.

The Annual Meeting will be conducted in a “hybrid” meeting format. Shareholders can participate either in person in the Enterprise Bank “Community Room,” located on the second floor of 18 Palmer Street, Lowell, Massachusetts 01852, or you have the option to attend the Annual Meeting by means of remote communication. Please refer to the accompanying Proxy Statement for instructions on how to remotely participate in the Annual Meeting.

It is important that your shares be represented at the Annual Meeting. Whether or not you plan to attend the Annual Meeting in person or by means of remote communication, you are requested to either (1) vote electronically using the Internet by following the instructions included with your proxy card, OR (2) vote by phone by following the instructions included with your proxy card, OR (3) vote by mail by completing, dating, signing and returning your proxy card in the enclosed postage paid envelope.

Thank you in advance for voting. We appreciate your continuingcontinued support of the Company.

Sincerely,

George L. Duncan

Chairman of the Board

ENTERPRISE BANCORP, INC.

222 MERRIMACK STREET

LOWELL, MASSACHUSETTS 01852

TELEPHONE: (978) 459-9000

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

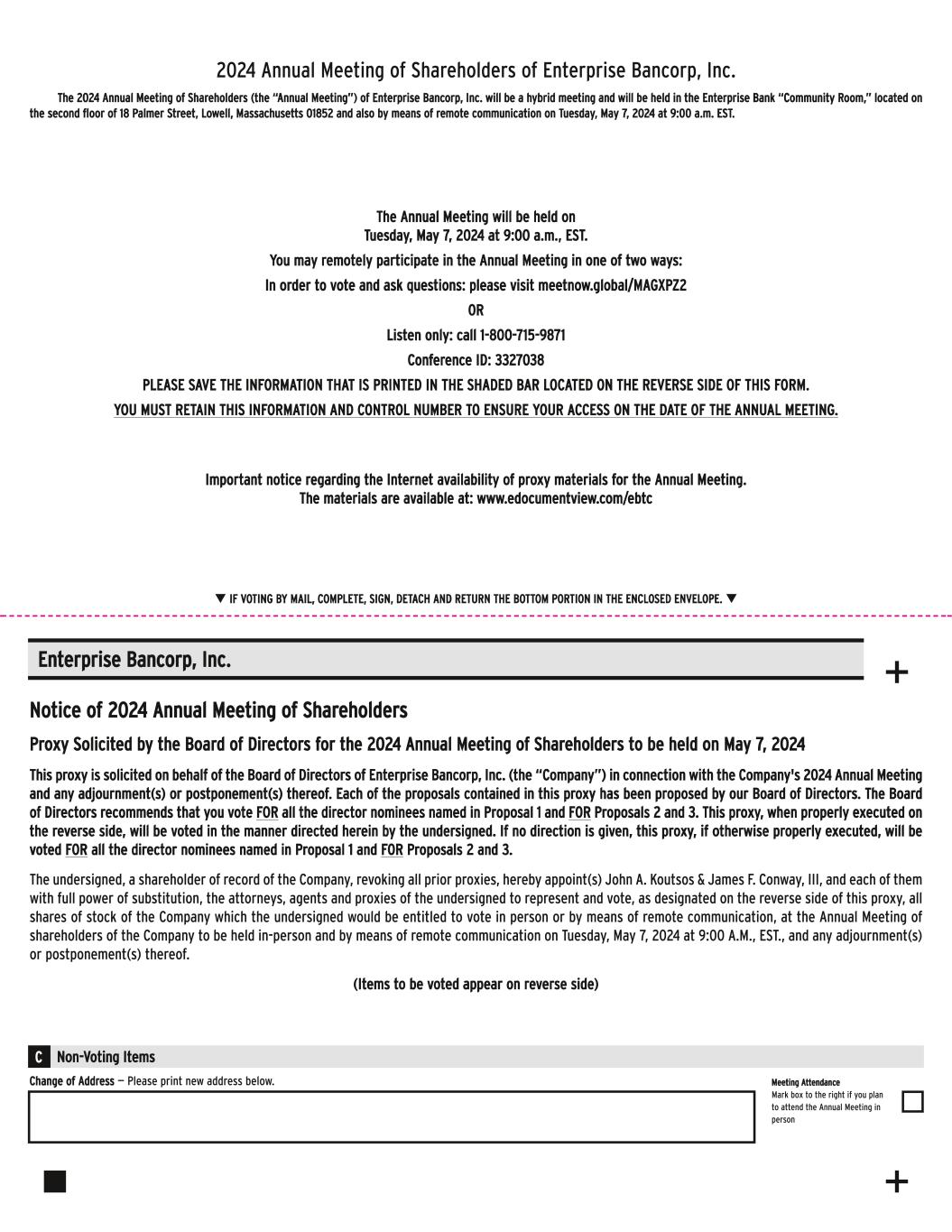

The 2024 Annual Stockholders' Meeting of Shareholders of Enterprise Bancorp, Inc. will be held on

Tuesday, May 7, 2024 at 9:00 a.m. local time

by means of remote communication

and

in person at the ENTERPRISE BANK “COMMUNITY ROOM”

UMASS LOWELL INN AND CONFERENCE CENTER18 Palmer Street, Second Floor

50 Warren StreetLowell, Massachusetts 01852

Lowell, MA 01852

on Tuesday, May 3, 2016 at 3:30 p.m. local time

The 2024 Annual Meeting of Shareholders (the “Annual Meeting”) of Enterprise Bancorp, Inc. (the “Company") is being held for the following purposes:

| |

1. | To vote on the reelection of George L. Duncan, Eric W. Hanson, Jacqueline F. Moloney, Luis M. Pedroso, Michael T. Putziger, Carol L. Reid and Michael A. Spinelli to serve as Directors of the Company, each for a three-year term;

|

2. 1.To elect Gino J. Baroni, John P. Clancy, Jr., James F. Conway, III, John T. Grady, Jr., and Mary Jane King to serve as Directors of the Company, each to serve for a three-year term expiring at the 2027 annual meeting of shareholders or until their respective successors are duly elected and qualified, or until their earlier resignation, death or removal from office;

2.To conduct a non-binding advisory vote to approve and adoptthe compensation of the Company's 2016 Stock Incentive Plan;named executive officers (the “Say on Pay Proposal”);

| |

3. | To vote on the ratification of the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016; and

|

| |

4. | To transact any other business that may properly come before the meeting or any adjournments or postponements thereof. |

3.To ratify the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

4.To transact any other business that may properly come before the Annual Meeting or any adjournment(s) or postponement(s) thereof.

You may vote at the Annual Meeting if you were a stockholdershareholder of record at the close of business on March 4, 2016.February 29, 2024.

The Annual Meeting will be conducted in a “hybrid” meeting format. Shareholders can participate either in person in the Enterprise Bank “Community Room,” located on the second floor of 18 Palmer Street, Lowell, Massachusetts 01852, or you have the option to attend the Annual Meeting by means of remote communication.

You may remotely participate in the Annual Meeting in one of two ways:

•In order to view the presentation, vote and ask questions: log onto www.meetnow.global/MAGXPZ2 with your control number provided on your proxy card; OR

•Listen only: call 1-800-715-9871 with conference ID: 3327038

Those planning to attend and participate in the Annual Meeting by means of remote communication should call in or log onto the Annual Meeting virtual platform at least 15 minutes prior to the start of the Annual Meeting. Shareholders may participate by voting and asking questions at the Annual Meeting either by logging on to the Annual Meeting virtual platform at www.meetnow.global/MAGXPZ2 with your control number provided on your proxy card, or by attending in person. You will not be able to vote or ask questions if you use the “listen only” option.

In the event there are not sufficient votes to approve any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in orderor postponed to permit further solicitation of proxies by the Company.

By Order of the Board of Directors,

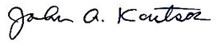

MichaelJohn A. SpinelliKoutsos

Secretary

222 Merrimack Street

Lowell, Massachusetts 01852

March 31, 2016April 3, 2024

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON OR BY MEANS OF REMOTE COMMUNICATION, PLEASE (1) VOTE ELECTRONICALLY USING THE INTERNET BY FOLLOWING THE INSTRUCTIONS INCLUDED WITH YOUR PROXY CARD, OR (2) VOTE BY PHONE BY FOLLOWING THE INSTRUCTIONS INCLUDED WITH YOUR PROXY CARD, OR (3) VOTE BY MAIL BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT PROMPTLY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU ATTEND THE ANNUAL MEETING AND DESIRE TO WITHDRAW YOUR PROXY AND VOTE IN PERSON, YOU MAY DO SO.

PROXY STATEMENT

ENTERPRISE BANCORP, INC.

222 MERRIMACK STREET

LOWELL, MASSACHUSETTS 01852

Telephone: (978) 459-9000

2024 ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

To Be Held on Tuesday,, May 3, 20167, 2024

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS

FOR THE 2024 ANNUAL STOCKHOLDERS' MEETING OF SHAREHOLDERS TO BE HELD ON

TUESDAY, MAY 3, 20167, 2024

TheThis Proxy Statement, andthe Company’s 2023 Annual Report to Shareholders, which contains additional information and results for the year ended December 31, 2023, and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 8, 2024 (the “Annual Report”), are also available, free of charge, to stockholdersshareholders at www.edocumentview.com/ebtc.

You may obtain directions to the UMassEnterprise Bank “Community Room” in Lowell, Inn and Conference Center in Lowell,Massachusetts, where our annual meetingthe Annual Meeting will be held this year, by going to the following website: http:https://continuinged.uml.edu/directionsicc.htmwww.enterprisebanking.com/Enterprise-Bank-Lowell-Campus

GENERAL INFORMATION

Introduction

This Proxy Statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors of Enterprise Bancorp, Inc. (the “Company”), the parent holding company of Enterprise Bank and Trust Company (the “Bank”), for the 20162024 Annual Meeting of StockholdersShareholders of the Company (the “Annual Meeting”), to be held both by means of remote communication and in person at the Enterprise Bank “Community Room,” 18 Palmer Street, Second Floor, Lowell, Massachusetts 01852 on Tuesday,, May 3, 2016,7, 2024, at 3:30 p.m.9:00 a.m. local time, at the UMass Lowell Inn and Conference Center, 50 Warren Street, Lowell, Massachusetts 01852 and at any adjournmentsadjournment(s) or postponementspostponement(s) thereof. This Proxy Statement, the accompanying Notice of the 2024 Annual Meeting and the accompanying proxy card are first being mailed to stockholders on or about March 31, 2016.April 3, 2024 to the Company’s shareholders of record as of the close of business on February 29, 2024.

The Annual Meeting has been called for the following purposes: (1) to elect seven(5) five individuals to serve as Directors of the Company, each to serve for a three-year term expiring at the 2027 annual meeting of shareholders or until their respective successors are duly elected and qualified, or until their earlier resignation, death or removal from office (“Proposal One”); (2) to conduct a non-binding advisory vote to approve and adopt the Company's 2016 Stock Incentive Plan (“Proposalcompensation of the Company’s named executive officers (the “Say on Pay Proposal” or “Proposal Two”); (3) to vote on the ratification of

ratify the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20162024 (“Proposal Three”); and (4) to transact such other business as may properly come before the Annual Meeting or any adjournmentsadjournment(s) or postponementspostponement(s) thereof.

Attending the Annual Meeting

The Company is Annual Meeting will be conducted in a Massachusetts corporation“hybrid” meeting format. You may attend the Annual Meeting in person or by remote communication. In both cases, shareholders will have substantially the same opportunities to participate in the Annual Meeting, including voting and a registered bank holding company. Allasking questions during the Annual Meeting at appropriate times. Please note that the Chairperson of the Company’s materialAnnual Meeting will only respond to questions pertinent to the business activitiesof the Annual Meeting. Please see below for further instructions on each method of participation.

In Person Attendance

The Annual Meeting will be held in person at the Enterprise Bank “Community Room,” 18 Palmer Street, Second Floor, Lowell, Massachusetts 01852. Directions to the Annual Meeting can be found at the link above.

If you are conducteda shareholder of record (i.e., you hold your shares in your own name with our transfer agent, Computershare, as opposed to through a bank, broker or other nominee), you may vote at the Bank.Annual Meeting in person or by proxy. Please see below for more information regarding the use of proxies.

Attendance by Remote Communication

Shareholders may participate in the Annual Meeting by means of remote communication in one of two ways:

•In order to view the presentation, vote and ask questions: log onto www.meetnow.global/MAGXPZ2 with your control number provided on your proxy card; OR

•Listen only: call 1-800-715-9871 with conference ID: 3327038

If you attend the Annual Meeting by means of remote communication, you will be provided the opportunity to ask questions and vote on matters submitted to shareholders, unless you participate via the "listen only" option. Shareholders who wish to vote and ask questions during the Annual Meeting must have the control number provided on your proxy card when logging on at www.meetnow.global/MAGXPZ2.Those without a control number may attend as guests of the Annual Meeting, but they will not have the option to vote their shares or ask questions during the Annual Meeting.

Those planning to attend and participate in the Annual Meeting by means of remote communication should call in or log onto the Annual Meeting virtual platform at least 15 minutes prior to the start of the Annual Meeting.

Anyone may enter the Annual Meeting as a guest in listen-only mode at 1-800-715-9871 with conference ID: 3327038 or www.meetnow.global/MAGXPZ2 , but only shareholders of record and beneficial owners of shares who have registered for the Annual Meeting may attend and participate in the Annual Meeting.

Registration for Beneficial Owners.If your shares are held in “street name” (i.e., you hold your shares through an intermediary, such as in a stock brokerage account or by a bank or other nominee), and you would like to ask a question and/or vote your shares at the Annual Meeting then you must register in advance in order to attend the Annual Meeting by means of remote communication. To register, you must submit a legal proxy that reflects your proof of proxy power. The legal proxy must reflect your holdings of shares of Company common stock, along with your name. Please forward a copy of the legal proxy, along with your email address, to Computershare. Requests for registration should be directed to Computershare either by email to legalproxy@computershare.com (forwarding the email from your broker or attaching an image of your legal proxy) or by mail to Computershare, EBTC Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001.

Requests for registration must be labeled as “Legal Proxy” and be received by Computershare no later than 5:00 p.m., EDT on May 1, 2024. You will receive a confirmation of your registration by email after Computershare receives your registration materials. To attend the Annual Meeting by means of remote communication at www.meetnow.global/MAGXPZ2, you will need to enter the control number provided in the confirmation sent by Computershare.

Record Date

The Board of DirectorsDirectors has fixed the close of business on March 4, 2016February 29, 2024 as the record date for the determination of stockholdersshareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournmentsadjournment(s) or postponementspostponement(s) thereof (the “Record Date”). Only holders of record of the Company’s common stock (the “Common Stock”) at the close of business on the Record Date will be entitled to vote.vote at the Annual Meeting. At the close of business on the Record Date, there were 10,409,98912,278,649 shares of the Common Stock issued and outstanding. The holders of shares of the Common Stock outstanding as of the close of business on the Record Date will be entitled to one vote for each share held of record upon each matter that may properly come before the Annual Meeting or any adjournmentsadjournment(s) or postponementspostponement(s) thereof.

Proxies

You If you are the record holder of your shares (i.e., you hold your shares in your own name with our transfer agent, Computershare, as opposed to through a bank, broker or other nominee), you may vote at the Annual Meeting in person, by means of remote communication, or by proxy. Proxies may be delivered electronically via the Internet, by telephone, or in writing by mail. If you intend to deliver a proxy electronically or by phone, you may do so by following the instructions included with your proxy card.

If you hold your shares in “street name,” such as in a stock brokerage account or through a bank or other nominee, you need to check your proxy card or contact yoursuch bank, broker or other nominee to determine whether electronic or telephonicshould provide you with these proxy delivery is available to you.materials, including a voting instruction card. If you intendhold your shares in “street name” and have not received these proxy materials, including a voting instruction card, from your bank, broker or other nominee, please contact the institution that holds your shares. As a street name shareholder, you may also be eligible to deliver a proxyvote your shares via the Internet or by mail, we requesttelephone by following the voting instructions provided by the bank, broker or other nominee that youholds your shares, using either the Internet address or the toll-free telephone number provided on the voting instruction card (if the bank, broker or other nominee provides these voting methods). Otherwise, please complete, date, sign and promptlydate the voting instruction card and return the accompanying proxy card in the enclosed envelope, which requires no postage if mailed in the United States.it promptly.

If you vote electronically or by telephone and you properly follow the instructions included with your proxy card for doing so by no later than the deadline indicated in such instructions or if you vote by mail and you return to the Company the enclosed proxy card properly executed to the Company in time to be voted at the Annual Meeting, then the shares

represented by your proxy, regardless of the method of delivery, will be voted in accordance with your voting instructions, unless you subsequently revoke your proxy as further explained below.

If you properly deliver your proxy without including any instructions as to how your proxy should be voted, then your proxy will be voted as follows: (1) FOR“FOR” the election of George L. Duncan, Eric W. Hanson, JacquelineGino J. Baroni, John P. Clancy, Jr., James F. Moloney, Luis M. Pedroso, MichaelConway, III, John T. Putziger, Carol L. ReidGrady, Jr., and Michael A. Spinelli ,Mary Jane King, as the sevenfive nominees of the Board of Directors, as Directors of the Company;Company, each to serve for a three-year term expiring at the 2027 annual meeting of shareholders or until their respective successors are duly elected and qualified, or until their earlier resignation, death or removal from office; (2) FOR“FOR” the approval and adoption of the Company's 2016 Stock Incentive Plan;Say on Pay Proposal; (3) FOR“FOR” the ratification of the Audit Committee’s appointment of RSM US LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016;2024; and (4) in such manner as management’s proxy-holders shallthe proxy holders decide on such other matters as may properly come before the Annual Meeting or any adjournmentsadjournment(s) or postponementspostponement(s) thereof.

The presence of a stockholdershareholder at the Annual Meeting, whether in person or by means of remote communication, will not automatically revoke a stockholder’sshareholder’s proxy. A stockholdershareholder may, however, revoke a proxy at any time before such proxy is voted at the Annual Meeting is called to order by filing with the Secretary of the Company a written notice of revocation, or by delivering to the Company a duly executed proxy bearing a later date, or by properly delivering a proxy electronically or by telephone at a later date. All written notices of revocation and other written communications with respect to revocation of proxies in connection with the Annual Meeting should be addressed as follows: Enterprise Bancorp, Inc., 222 Merrimack Street, Lowell, Massachusetts 01852, Attention: MichaelJohn A. Spinelli,Koutsos, Secretary.

It is not anticipated that any matters other than those set forth in proposalsProposals One, Two, and Three will be brought before the Annual Meeting. The Company has not received any proper proposals from its shareholders to be included in this Proxy Statement or otherwise brought before the Annual Meeting. Please see the additional information under the heading “Stockholder“Shareholder Proposals” on page 4659 of this Proxy Statement, below, for a description of the requirements that must be satisfied in order for any Director nomination or other stockholdershareholder proposal, which is not otherwise included in this Proxy Statement, to be presented by any stockholdershareholder at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon such matters in their discretion in accordance with their best judgment.

In addition to use of the mails, proxiesProxies may be solicited personally or by mail, telephone, fax or e-mail by officers, Directors and employees of the Company, none of whom will be specially compensated for such solicitation activities. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries for forwarding solicitation materials to the beneficial owners of shares held of record by such persons, and the Company will reimburse such persons for their reasonable out of pocket expenses incurred in connection with that connection.solicitation. The cost of soliciting proxies will be borne by the Company.

Quorum; Vote Required

The presence, whether in person, by means of remote communication, or by proxy, of at least a majority of the total number of outstanding shares of the Common Stock is necessary to constitute a quorum at the Annual Meeting for the transaction of business. Abstentions and withheld votes, and shares held by a bank, broker or other nominee that areas long as there is one routine matter to be voted on any matterat the meeting, such as the ratification of appointment of RSM US, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 (Proposal Three), broker non-votes will be counted as present for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

The number of affirmative votes required for approval of the matters to be considered at the Annual Meeting is as follows:

•Proposal One - Election of Class of Directors

Each Director is required to be elected by a majority of the votes cast by stockholdersshareholders present, whether in person, by means of remote communication, or by proxy, at the Annual Meeting. At the Annual Meeting, the maximum number of Directors to be elected is sevenfive (5).

•Proposal Two - Approval of 2016 Stock Incentive Planthe Say on Pay Proposal

The approval and adoption of the Company's 2016 Stock Incentive Plan requiresSay on Pay Proposal will be approved on a majority ofnon-binding advisory basis if the votes cast by stockholdersshareholders present, whether in person, by means of remote communication, or by proxy, at the Annual Meeting.Meeting favoring the Say on Pay Proposal exceed the votes cast by shareholders present, in person, by means of remote communication, or by proxy, at the Annual Meeting opposing the Say on Pay Proposal.

•Proposal Three - Ratification of Appointment of Independent Registered Public Accounting Firm

The ratification on a non-binding, advisory basis, of the appointment of RSM US LLP as our independent registered public accounting firm for 2016the year ending December 31, 2024 requires a majority ofthat the votes cast by stockholdersshareholders present, whether in person, by means of remote communication, or by proxy, at the Annual Meeting.Meeting favoring the ratification exceed the votes cast by shareholders present, in person, by means of remote communication, or by proxy, at the Annual Meeting opposing the ratification.

In voting for the election of Directors, you may vote “FOR” all nominees or “WITHHOLD” your vote from“AGAINST” all nominees or from only certain specified nominees. Withholding a vote from all or some of the nominees is effectively a vote against such nominee(s), but will not prevent the election of such nominee(s) so long as such nominee(s) receive a majority of the votes cast at the Annual Meeting.

In voting for the approval and adoption of the Company's 2016 Stock Incentive Plan, you may vote "FOR" or "AGAINST" such approval and adoption or you may "ABSTAIN"“ABSTAIN” from voting on the matter. Under Massachusetts law, an abstention is not considered a vote cast at a shareholder meeting and, consequently, abstentions will have no effect on the voting for this proposal.Proposal One.

In voting for the Say on Pay Proposal, you may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on the matter. Under Massachusetts law, an abstention is not considered a vote cast at a shareholder meeting and, consequently, abstentions will have no effect on the voting for this Proposal Two.

In voting for the ratification of the appointment of RSM US LLP as our independent registered public accounting firm for 2016,2024, you may vote “FOR” or “AGAINST” such ratification or you may “ABSTAIN” from voting on the matter. Under Massachusetts law, an abstention is not considered a vote cast at a shareholder meeting and, consequently, abstentions will have no effect on the voting for this proposal.Proposal Three.

Under existing stock exchange rules, banks, brokers, or other nominees may vote shares held for a customer in street name on matters that are considered to be “routine” even if they have not received voting instructions from

their clients. A broker “non-vote” occurs when a bank, broker, or other nominee has not received voting instructions from a customer and does not vote the customer’s shares either because the matter is not considered routine or because the bank, broker or other nominee does not exercise its prerogative to vote even if the matter is considered routine.

The

Proposals One and Two, namely the election of Directors (Proposal One) and the approval and adoption of the 2016 stock incentive plan (Proposal Two),Say on Pay Proposal, are not considered “routine” matters, which means that if your shares are held in street name, your bank, broker, or other nominee may not vote your shares on this matter unless you provide timely instructions for such voting. TheBroker non-votes will not be deemed votes cast at the Annual Meeting for Proposals One and Two and as such, will have no effect on the voting for Proposals One and Two. It is, therefore, important that you vote your shares.

Proposal Three, namely the ratification of the appointment of the independent registered public accounting firm, (Proposal Three), is considered a “routine” matter, which means that if your shares are held in street name, your bank, broker, or other nominee may vote your shares on this matter in its sole discretion if you do not provide timely instructions for voting your shares.

The Directors and executive officers of the Company have indicated that they intend to vote all shares of the Common Stock that they are entitled to vote in favor of each of“FOR” Proposals One, Two and Three. On the Record Date, the Directors and executive officers of the Company in the aggregate had the right to vote 2,170,6802,593,581 shares of the Common Stock, representing approximately 20.85%21.12% of the outstanding shares of the Common Stock as of such date.

PROPOSAL ONE

ELECTION OF CLASS OF DIRECTORS

The Company’s Second Amended and Restated By-Laws (the "By-Laws"“By-Laws”) provide that the number of Directors shall be set by a majority vote of the entire Board of Directors. Currently, the number of Directors for the Company has beenis set at 18 through the date of the Annual Meeting.18. Under the Company’s Restated Articles of Organization, as amended, and By-Laws, this number is divided into three classes, as nearly equal in number as possible, with the Directors in each class serving a term of three years and until their respective successors are duly elected and qualified, or until his or her earlier resignation, death or removal.removal from office. As the term of one class expires, a successor class is elected at the annual meeting of stockholdersshareholders for that year.

On January 19, 2016, Arnold S. Lerner, former Vice Chairman and Lead Director, retired

The Board of Directors currently includes Shelagh E. Mahoney, who will retire from the Board of Directors. On January 19, 2016, Joseph C. Lerner, his son, was appointed asDirectors upon the completion of the Annual Meeting. The Board of Directors has passed a director forresolution setting the number of Directors of the Company andat 17 effective immediately upon the Bank to serve untilcompletion of the 2017 Annual Meeting of Stockholders.Meeting.

At the Annual Meeting, there are seven Directorsfive (5) individuals to be elected as Directors of the Company for a three year term to serve until the 2019 Annual Meeting2027 annual meeting of Stockholdersshareholders and until their respective successors are duly elected and qualified, or until his or her earlier resignation, death or removal. The Board of Directors has nominated, uponremoval from office. Upon the recommendation of the Board’s Corporate Governance/Nominating Committee of the Board of Directors, the full Board of Directors nominated each of George L. Duncan, Eric W. Hanson, JacquelineGino J. Baroni, John P. Clancy, Jr., James F. Moloney, Luis M. Pedroso, MichaelConway, III, John T. Putziger, Carol L. ReidGrady, Jr., and Michael A. Spinelli ,Mary Jane King, for election as a Director of the Company for a three-year term.term to serve until the 2027 annual meeting of shareholders and until their respective successors are duly elected and qualified, or until his or her earlier resignation, death or removal from office.

The Board of Directors believes that all of the above-listed nominees will stand for election and will serve as a Director of the Company, if elected. However, if any person nominated by the Board of Directorsnominee fails to stand for election or is unable or refuses to accept election, the proxies will be voted for the election of such other person or persons as the Board of Directors may recommend. However,Alternatively, in lieu of designating a substitute, the Board of Directors may reduce the number of Directors.Directors of the Company.

Information Regarding Nominees

The following table sets forth certain information for each of the sevenfive (5) above-listed nominees for election as Directors at the Annual Meeting. Each individual has been engaged in his or her principal occupation for at least five years.years, except as otherwise indicated.

Nominees (Term to expire in 2019)

|

| | | | |

Name, Age, and Principal Occupation and Qualifications | Director Since (1) |

George L. Duncan (75)Gino J. Baroni (67)

ChairmanOwner and Managing Principal, Trident Project Advantage Group, project advisors to public and private entities in capital improvement projects and real estate development. Owner of commercial, residential and tax-credit projects.

Qualifications: Mr. Baroni’s depth of experience in project management, construction management and real estate development, including his experience as an executive officer within large companies and his familiarity with finance, risk management, legal/contract review and negotiations, budget development, and internal controls, provides an enhanced level of expertise and depth of experience to the Board in multiple strategic areas, such as commercial and construction lending, geographic expansion and business development. Mr. Baroni also adds value to the Board by bringing local knowledge to the Board through his service on various civic boards representing several communities that are served by the Bank. | 2010 |

| |

John P. Clancy, Jr. (66) Chief Executive Officer of the Company and the Bank; prior to 2007, Executive Vice President and Chief Operating Officer of the Bank; prior to 2004, President of the Company; prior to 2002, Executive Vice President, Treasurer, Chief Financial Officer and Chief Investment Officer of the Bank.

| 2003 |

Qualifications: Mr. Clancy’s bank-related experience in finance, investment, strategy, management, risk oversight, banking regulations and operations provides invaluable insight to the Board’s oversight of operations and its strategic planning function. His prior experience serving as Chief Financial Officer, Chief Investment Officer and Chief Operating Officer of the Company and the Bank since their inception.

Qualifications: Mr. Duncan's 50 plus years of experience with financial institutions and commercial lending provides a skill set that is extremely valuable within the Board with expansive knowledge relating to credit risk, loan portfolio management and bank management in varying market conditions. Mr. Duncan's role as Chairman and former Chief Executive Officercontext of the Company, along with hisBoard’s decision-making process. Mr. Clancy’s past tenure as chief executive officerChief Financial Officer of an earlier Greater Lowell-based independent commercial bank prior to his founding ofjoining the Bank and leadership positions at many local, community non-profit organizations, also provideprovides valuable industry specific and local community experience market knowledge and contacts.

| | 1988

| |

| |

Eric W. Hanson (72)James F. Conway, III (71)

Former Executive Vice President of RR Donnelley; prior to December 2016, Executive Vice President of RR Donnelley, a publicly held integrated communication service company providing print, digital and supply chain solutions. Since May 2015, Vice Chairman of the Board and Chief Financial Officer of Klin Groupe, LLC, a privately held distributor of imported Russian vodka; since May 2013, Assistant SecretaryLead Director of the Company and the Bank. Qualifications: Mr. Hanson's ownership and management of a major regional distributor and familiarity with local businesses, individuals, market trends and conditions adds valueBank; prior to the Board by providing a substantial depth of general business knowledge, particularly related to retail businesses, and extensive local community experience and contacts.

| 1991 |

| |

Jacqueline F. Moloney (62)

Chancellor, University of Massachusetts - Lowell, the third largest state educational institution in Massachusetts. Prior to AugustJune 2015, Executive Vice Chancellor, University of Massachusetts - Lowell.

Qualifications: Dr. Moloney's experience with leadership, budgeting, strategic planning, technology and innovation adds value to the operating committees of the Board and enhances the Board's overall understanding of the Bank's operating environment and internal control structure. Dr. Moloney has served on numerous civic boards throughout the Merrimack Valley and provides valuable knowledge and insight to the Board on emerging industries and business trends within the Bank's market area, as well as local developments affecting the Greater Lowell community.

| 2010 |

| |

|

| |

Name, Age and Principal Occupation | Director Since (1) |

Luis M. Pedroso (56) Since 2003, President, and Chief Executive Officer of Accutronics, Inc., a privately held electronic contract manufacturing facility.

Qualifications: Mr. Pedroso’s experience as a business owner of a manufacturing facility provides him with a unique understanding of business operations, finances, employment matters, strategic planning and leadership development. The philanthropic efforts of Mr. Pedroso, his commitment and involvement in community and civic organizations, his familiarity with the Greater Lowell region, and his active participation in the mentoring and development of young leaders strengthen the Board's commitment to customer service, strategic planning, financial knowledge, leadership developments and operations at the Company.

| 2014 |

| |

Michael T. Putziger (70)

Chairman, of WinnCompanies, a private real estate company that develops, acquires and manages multi-family and mixed income properties nationwide; Of Counsel to Murtha Cullina, LLP, a law firm that provides legal services to businesses, governmental units, non-profit organizations and individuals; Chairman of the Board of Directors of Bank of FloridaCourier Corporation, a publicly held company that formerly operated as a multi-bank holding company; prior to August 2012, member of the Board of Directors of New Hampshire Thrift Bancshares, the publicly held parent company of Lake Sunapee Bank, a federally chartered savings bank. Qualifications: Mr. Putziger's legal experience and familiarity with commercial real estate development, financial institutions, banking industry trends and public markets provide value to all aspects of the Board's decision-making process. Mr. Putziger's service as chairman of a publicly traded, multi-bank holding company and as a director of a publicly traded thrift holding company and its subsidiary federal savings bank also provides him with substantial experience in the banking and thrift industries and with respect to relevant industry activities and challenges. This experience has been of value to the Board in, among other areas, its oversight of the Company's wealth management services and its consideration of various capital raising alternatives for the Company.

| 2008 |

| |

Carol L. Reid (68)

Retired Financial Executive; prior to September 2005, Vice President, Corporate Controller and Chief Accounting Officer of Avid Technology, Inc., a publicly held company specializing in digital media creation tools for film, audio, animation, gamesthe publishing, printing and broadcast.sale of books.

| 1989 |

| |

Qualifications: Ms. Reid's past roleWith over 21 years of experience as the chairman and chief executive officer of a corporate controller of an international publicgrowing publicly traded company benefits the Board in its oversightthat employed approximately 1,500 individuals, Mr. Conway’s financial expertise, SEC reporting experience and knowledge of the Company's riskpublic markets add great depth to the Board’s understanding of current market trends, governance standards, capital funding, human resources and compensation, and management program, internal control structure and financial reporting process. Ms. Reidof risk. Mr. Conway possesses the qualifications necessary to be designated an "Audit Committee“audit committee financial expert"expert” under applicable SEC rules,rules. | |

| | | | | |

Name, Age, Principal Occupation and she has been designated as such for purposes of her membership on the Audit Committee.Qualifications | 2006 |

| Director Since (1) |

Michael A. Spinelli (83)John T. Grady, Jr. (76) Senior Advisor at G2 Capital Advisors, providing investment banking and restructuring advisory services; Managing Partner of JTG Partners providing business and financial consulting to Family Offices and Privately held businesses; prior to 2020, Senior Advisor, Moelis & Company, a leading global independent investment bank that provides innovative strategic advice and solutions to a diverse client base, including corporations, governments and financial sponsors; prior to November 2016 director of Bank of Cape Cod and its publicly traded holding company, New England Bancorp, Inc.

Founder, Global Tourism Solutions, an international tourism consulting firm for emerging nations; Secretary

| 2013 |

Qualifications: Mr. Grady’s experience in financial services in senior positions across investment management, private wealth management and banking, his leadership positions held at various community non-profit organizations, as well as his long-term connections within the New England business community add value to the Company’s wealth management, decision-making and strategic planning processes. Mr. Grady’s deep knowledge of the financial services industry and experience serving on boards of financial institutions provides him with insights into the challenges and opportunities that are faced by community banks. | |

| |

Mary Jane King (70) President, Conway Management Company, a private consulting company that helps Fortune 500 and mid-size companies improve quality and productivity, decrease costs and increase customer satisfaction by educating leaders in Business Process Improvement. Vice President and Member, Conway Capital Management LP, a private family owned investment firm which invests in private equity and real estate.

Qualifications: Ms. King’s experience with business leadership, process improvement, strategic planning, financial analysis and auditing, her leadership involvement in the Bank.

Qualifications: Mr. Spinelli addscommunity, as well as her knowledge of the Greater Nashua community both add value to the Board through hisand provide enhanced community relations in our Southern New Hampshire markets. Ms. King’s experience as a business ownerstrengthens the Board’s oversight of multiple companies, including a company providing services to over 2,000 travel agencies, his experience in independent investment portfolio management, his knowledge of internationalinternal controls, operational processes and strategic planning and provides additional familiarity with the Southern New Hampshire markets and his general marketing and financial acumen.that we serve.

| 19882014 |

| |

(1)All of the listed individuals are also directors of the Bank. The years listed in the foregoing table are the respective years in which each named individual first became a director of the Company and the Bank or, if prior to the Company’s formation in 1996, of the Bank.

| |

(1) | All of the listed Directors are also Directors of the Bank. The years listed in the foregoing table are the respective years in which each named individual first became a Director of the Company and the Bank or, if prior to the Company’s formation in 1996, of the Bank. |

For information regarding the remaining members of the Board of Directors, who are not up for re-election this year and will continue to serve as Directors of the Company after the Annual Meeting, see the listing under the heading Continuing Directors“Continuing Directors” on pages 13-1612-16 of this Proxy Statement, below.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholdersshareholders vote FOR the election of each of the five (5) nominees named above to serve as Directors of the Company until the 2019 annual meeting of stockholders and until their successors are duly elected and qualified.above.

PROPOSAL TWO

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

APPROVAL OF 2016 STOCK INCENTIVE PLAN

Description of 2016 Stock Incentive Plan

On January 19, 2016,In accordance with the Board of Directors unanimously approvedDodd-Frank Wall Street Reform and adopted the Enterprise Bancorp, Inc. 2016 Stock Incentive Plan (the “Stock Incentive Plan” or the “Plan”)Consumer Protection Act and directed that the Stock Incentive Plan be submitted to the Company’s stockholders for their consideration and approval.

Purpose, Participants, Effective Date and Duration. The purpose of the Stock Incentive Plan is to encourage and enable the officers, employees, non-employee directors and consultants of the Company and its subsidiaries (including without limitation the Bank) upon whose judgment, initiative and efforts the Company largely depends for the successful conduct of its business to acquire a proprietary interest in the Company. The Stock Incentive Plan allows for the granting of shares of Common Stock, options to acquire Common Stock (“Options”), shares of Common Stock subject to restrictions (“Restricted Stock”), rights based on the value of the Common Stock (“Restricted Stock Units” or “RSUs”) and rights based on future appreciation in the value of the Common Stock (“Stock Appreciation Rights” or “SARs”). Grants of Common Stock, Options, Restricted Stock, RSUs and/or SARs are referred to collectively in this summary as “Awards.”

The majority of the shares of Common Stock reserved for issuance pursuant to the Company’s Amended and Restated 2009 Stock Incentive Plan are subject to previously granted and currently outstanding Options and shares of Restricted Stock. The remaining shares under the Company's Amended and Restated 2009 Stock Incentive Plan will remain available for future grants. Consequently, the Board of Directors believes that the adoption of the Stock Incentive Plan is necessary to enable the Company to continue in the future to attract and retain the high caliber of employees and directors required for the Company’s continuing growth and success.

As of the date of this Proxy Statement, there are 15 non-employee Directors, 14 executive officers (including three employee Directors) and approximately 460 other employees, including other officers, who would be eligible participants under the Stock Incentive Plan. The Stock Incentive Plan allows Awards to others, including consultants and advisers. As of the date of this Proxy Statement, there are 29 individuals on Bank Advisory Boards who would be eligible participants under the Stock Incentive Plan.

The Stock Incentive Plan remains subject to approval by the Company’s stockholders. If the Stock Incentive Plan is approved by stockholders at the Annual Meeting or any subsequent meeting held no later than January 19, 2017, then the Plan will remain in effect through January 19, 2026, unless earlier terminated by the Board of Directors. Any early termination of the Stock Incentive Plan by the Board of Directors will not affect Awards granted prior to such termination, but no additional Awards may be granted after any termination of the Plan.

Shares Subject to the Stock Incentive Plan. The total number of shares of Common Stock that may be subject to Awards under the Stock Incentive Plan may not exceed 350,000 (the “Reserved Shares”), which equals approximately 3.4% of the number of shares of Common Stock outstanding on the Record Date. These shares may be authorized but unissued shares or treasury shares. In the event of any change in the number or kind of Common Stock outstanding pursuant to a reorganization, recapitalization, exchange of shares, stock dividend or split or combination of shares, appropriate adjustments to the number of Reserved Shares and the number of shares subject to outstanding Awards, in the exercise price per share of outstanding Options and in the kind of shares which may be distributed under the Stock Incentive Plan will be made. The total amount of Reserved Shares that may be granted to any single employee under the Stock Incentive Plan may not exceed in the aggregate 120,000 shares. Shares will be deemed issued under the Stock Incentive Plan only to the extent actually issued pursuant to an Award. To the extent that an Award under the Stock Incentive Plan lapses or is forfeited, any shares subject to such Award will again become available for grant under the terms of the Stock Incentive Plan.

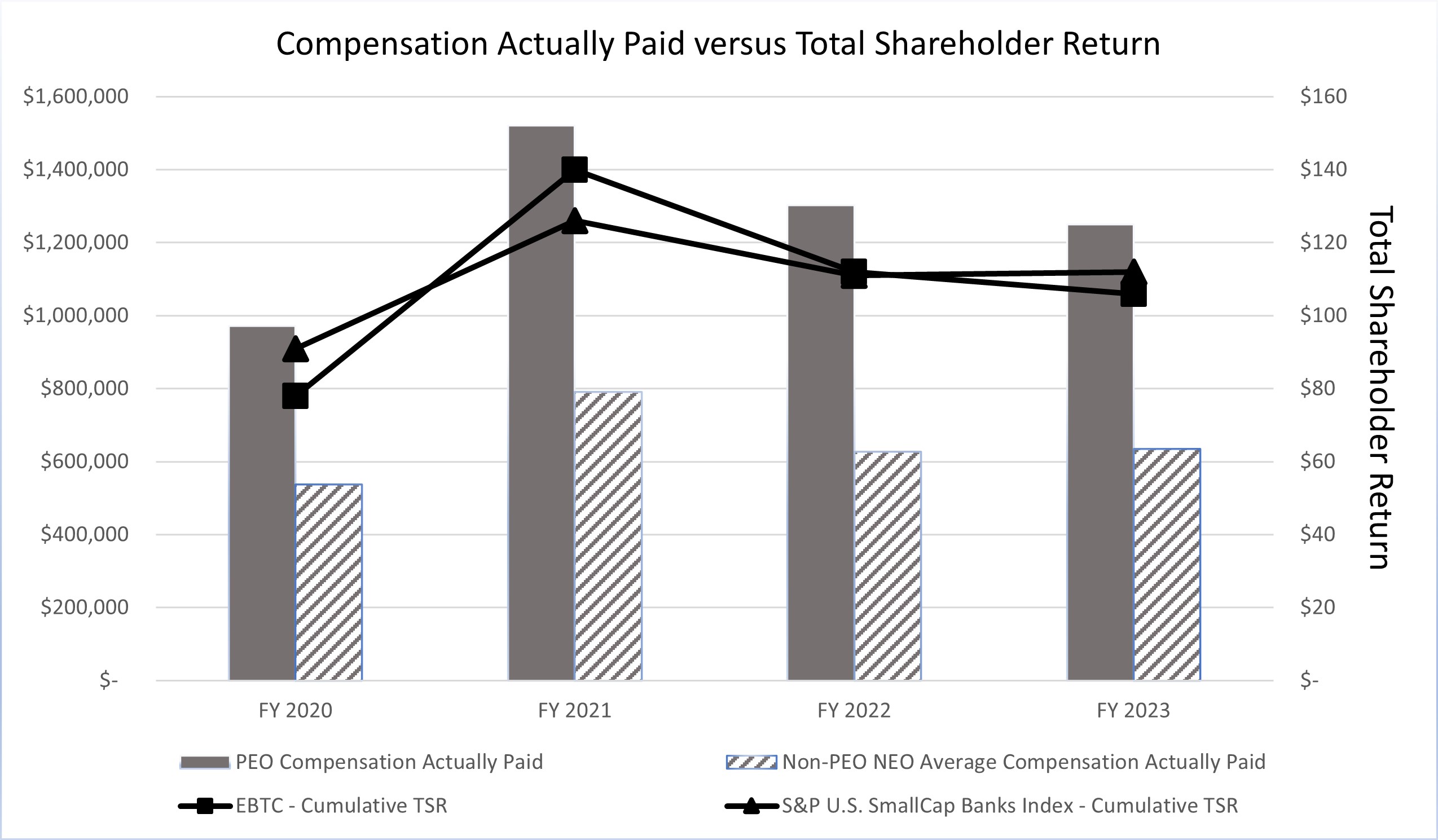

Administration. The Stock Incentive Plan may be administered by the Board of Directors’ Compensation Committee, which must consist of at least three members of the Board who are not employees of the Company or any of its subsidiaries, or by the Board of Directors itself. References to the “Compensation Committee” in this summary are intended to refer to the Compensation Committee or the full Board of Directors, as the case may be, unless the context requires otherwise. For so long as Section 1614A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is applicable to the Company each member ofis providing shareholders the Compensation Committee must be a “non-employee director”opportunity to endorse or not endorse the equivalent within the meaning of the SEC’s Rule 16b-3 promulgated under the Exchange Act. For so long as Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), is applicable to the Company, each such member of the Compensation Committee must also be an “outside director” within the meaning of Section 162 of the Code and the regulation thereunder. With respect to persons subject to Section 16 of the Exchange Act (generally,Company’s compensation program for our named executive officers directors and any 10% stockholders), all transactions underas disclosed in this Proxy Statement by voting for or against the Stock Incentive Plan are intended to comply with all applicable conditionsresolution set forth below.

At the Company’s 2021 annual meeting of the SEC’s Rule 16b-3 or any successor regulation.

Subject to the termsshareholders, over 81% of the Stock Incentive Plan, the Compensation Committee has authority to: (i) select the persons to whom Awards shall be granted; (ii) determine the number or value and the terms and conditions of Awards granted to each such person, including the price per share to be paid upon exercise of any Option and the period within which each such Option may be exercised; and (iii) interpret the Stock Incentive Plan and prescribe rules and regulations for the administration thereof. Unless otherwise provided or prohibited by law, all determinations and decisions made by the Company pursuant to the Plan shall be final, binding and conclusive on all parties. Notwithstanding the Compensation Committee’s general authority to grant Awards and administer the Plan, the full Board of Directors must approve all grants of Awards to all executive officers and any directors of the Company.

Stock Grants. Subject to the terms and provisions of the Plan and applicable law, the Administrator may, at any time and from time to time, make grants of Stock without receiving cash consideration therefor. Unless otherwise determined by the Administrator, grants of Stock shall be fully vested upon delivery of shares to the grantee either in certificate or electronic form. Each grant of Stock hereunder may be evidenced by an Award Agreement that shall specify the number of shares of Stock granted, any conditions which must be satisfied, and such other provisions as the Administrator shall determine.

Stock Options. In granting Options under the Plan, the Compensation Committee will determine the number of shares of Common Stock subject to the Option, the exercise pricewere cast in support of the Option,Company’s proposal to change the manner and time of exercisefrequency of the OptionSay on Pay proposal to be held on an annual basis. Accordingly, beginning in 2021, the Company has included the Say on Pay proposal in its proxy statement on an annual basis.

Your vote on this Say on Pay Proposal is strictly advisory in nature and whether the Option is intended to qualify as an incentive stock option (“ISO”) within the meaning

of Section 422 of the Code. Options that are not intended to qualify as ISOs are referred to as nonqualified stock options (“NSOs”). In the case of an ISO, the exercise price may not be less than the “fair market value” of the Common Stockbinding in any way on the date the Option is granted; provided, however, that in the case of an employee who owns (or is considered to own under Section 424(d) of the Code) stock possessing more than 10% of the total combined voting power of all classes of stock of the Company, or any of its subsidiaries, the price at which Common Stock may be purchased pursuant to an ISO may not be less than 110% of the fair market value of the Common Stock on the date the ISO is granted.

The duration of the ISOs and NSOs granted under the Stock Incentive Plan may be specified pursuant to each respective stock option agreement, but in no event can any ISO be exercisable after the expiration of 10 years after the date of grant. In the case of any employee who owns (or is considered under Section 424(d) of the Code as owning) stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of its subsidiaries, no ISO shall be exercisable after the expiration of five years from its date of grant. The Compensation Committee, in its discretion, may provide that any Option is exercisable during its entire duration or any lesser period of time.

The option exercise price may be paid in cash, in shares of Common Stock owned by the optionee (subject to certain limitations specified in the Stock Incentive Plan), or by means of a “cashless exercise” procedure in which a third-party designee transmits funds to the Company in accordance with procedures specified in the Plan.

Restricted Stock. The Compensation Committee may grant to participants a number of shares of Common Stock determined in its discretion, subject to terms and conditions so determined by it, including conditions that may require the holder to forfeit the Common Stock in the event that the holder ceases to provide services to the Company or a subsidiary before a stated time. Unlike holders of Options, a holder of Restricted Stock has the rights of a stockholder of the Company to vote the shares and, depending upon the terms of the grant, may also be entitled to receive payments of dividends on the Restricted Stock.

Restricted Stock Units and Stock Appreciation Rights. The granting of RSUs and SARs involve rights based on the value and the appreciation in value, if any, of the Common Stock, respectively, and do not involve in either instance the issuance of any shares at the time of grant. The terms and conditions of any RSUs and SARs that may be granted under the Plan will be determined in the sole discretion of the Compensation Committee at the time of grant, including vesting requirements and whether vested benefits may be settled in cash and/or shares of Common Stock.

Effect of Certain Corporate Transactions. If while unexercised or otherwise unvested Awards remain outstanding under the Stock Incentive Plan the Company is subject to a Change in Control (as such term is defined in the Stock Incentive Plan) or is liquidated, then, except as otherwise specifically provided to the contrary in any applicable agreement, (i) each such Option outstanding immediately prior to the effective time of such Change of Control or liquidation shall become immediately exercisable upon such effective time with respect to all of the Reserved Shares subject to such Option, whether or not the participant’s rights under such Option would otherwise have been so fully exercisable at such time, and (ii) each holder of shares of Restricted Stock, RSUs and/or SARs outstanding immediately prior to the effective time of such Change in Control or liquidation shall become fully vested upon such effective time with respect to such holder’s ownership of such shares or rights under such RSUs and/or SARs, whether or not such holder would otherwise have been so fully vested with respect to such shares or rights at such time.

Amendments to Stock Incentive Plan. The Board of Directors may amend or discontinue the Plan at any time and the Board of Directors or the Compensation and Human Resources Committee as the case may be, may also amend or cancel any outstanding Award at any time for the purpose of satisfying any changes in law or for any other lawful purpose, except that no such amendment, discontinuation or cancellation of the Plan orBoard of any Awards may adversely affectDirectors (the “Compensation and Human Resources Committee”). Nonetheless, the rightsCompensation and Human Resources Committee will review the results of any holder of an outstanding Award without the holder’s consent. Any amendmentvoting, take into account such results when considering future executive compensation arrangements and otherwise making recommendations to the Plan will requireBoard of Directors with respect to such matters.

At the approval2023 annual meeting of the Company’s stockholders if and to the extent required under the rules of any stock exchange

or market system on which the Common Stock is listed, or required to ensure that any outstanding ISOs granted under the Plan remain qualified under Section 422shareholders, over 82% of the Code, or to ensure that compensation earned under Awards qualifies as performance-based compensation under Section 162(m) of the Code, or required to ensure the availability to the Plan of the protections of Section 16(b) of the Exchange Act or as may otherwise be required for any other reason under applicable law.

The following description of the federal income tax consequences of Options, Restricted Stock, Restricted Stock Units and Stock Appreciation Rights is general and does not purport to be complete.

Tax Treatment of Options. A participant realizes no taxable income when an NSO is granted. Instead, the difference between the fair market value of the Common Stock subject to the NSO and the exercise price paid is taxed as ordinary compensation income when the NSO is exercised. The difference is measured and taxed as of the date of exercise, if the stock is not subject to a “substantial risk of forfeiture,” or as of the date or dates on which the risk terminates in other cases. A participant may elect to be taxed on the difference between the exercise price and the fair market value of the Common Stock on the date of exercise, even though some or all of the Common Stock acquired is subject to a substantial risk of forfeiture. Gain on the subsequent sale of the Common Stock is taxed as a capital gain. The Company receives no tax deduction on the grant of a NSO, but is entitled to a tax deduction when the participant recognizes taxable income on or after exercise of the NSO, in the same amount as the income recognized by the participant.

Generally, a participant incurs no federal income tax liability on either the grant or the exercise of an ISO, although a participant will generally have taxable income for alternative minimum tax purposes at the time of exercise equal to the excess of the fair market value of the stock subject to an ISO over the exercise price. Provided that theoutstanding shares of Common Stock are held for at least one year after the date of exercisewere cast in support of the Company's compensation of its named executive officers. The Company believes that its executive compensation program furthers the interests of its shareholders by providing proper incentives to its senior management to achieve both long-term and short-term goals without taking unnecessary or excessive risks that could threaten the Company’s financial condition or prospects. The objectives and design of the Company's compensation program for the named executive officers listed under "Compensation Discussion and Analysis - Overview", including the different components of compensation and the rationale for each component, are described in detail under the heading “Compensation Discussion and Analysis” at pages 25-33 of this Proxy Statement, below. Shareholders are urged to read the “Compensation Discussion and Analysis” section, the accompanying compensation tables and the related ISOnarrative disclosure in this Proxy Statement, which more thoroughly discuss the Company’s compensation policies and at least two years after its date of grant, any gain realizedprocedures.

Accordingly, the Company is asking shareholders to vote on the subsequent salefollowing non-binding advisory resolution:

RESOLVED, that the shareholders of Enterprise Bancorp, Inc. hereby approve, on a non-binding advisory basis, the stock will be taxed as long-term capital gain. If the stock is disposed of within a shorter period of time, the participant will be taxed as if the participant had then received ordinary compensation income in an amount equalpaid to the difference between the fair market value of the stock on the date of exercise of the ISO and its fair market value on its date of grant. The Company receives no tax deduction on the grant or exercise of an ISO, but is entitled to a tax deduction if the participant recognizes taxable income on account of a premature disposition of ISO stock,Company’s named executive officers, as disclosed in the same amount“Compensation Discussion and atAnalysis” section, the same time asaccompanying compensation tables and the participant’s recognition of income.

Tax Treatment of Restricted Stock. A person who receives a grant of Common Stock subject to restrictions generally will not recognize taxable income atrelated narrative disclosure in the time the award is received, but will recognize ordinary compensation income when any restrictions constituting a substantial risk of forfeiture lapse. The amount of imputed income will be equal to the excess of the aggregate fair market value, as of the date the restrictions lapse, over the amount (if any) paid by the holderCompany’s Proxy Statement for the Restricted Stock. Alternatively, a recipient2024 Annual Meeting of Restricted Stock may elect to be taxed on the excess of the fair market value of the Restricted Stock at the time of grant over the amount (if any) paid for the Restricted Stock, notwithstanding the restrictions on the stock. Outright grants of Common Stock (i.e., grants without any restrictions) will result in ordinary compensation income to the participant. All such taxable amounts are deductible by the Company at the time and in the amount of the ordinary compensation income recognized by the participant.Shareholders,

Tax Treatment of Restricted Stock Units and Stock Appreciation Rights. A participant incurs no imputed income upon the grant of an RSU or SAR, but upon its exercise realizes ordinary compensation income in an amount equal to the cash and/or fair market value of the Common Stock (if the RSU or SAR is settled in whole or in part in shares of Common Stock) that the participant receives at that time. All such taxable amounts are deductible by the Company at the time and in the amount of the ordinary compensation income recognized by the participant. This description assumes that the terms of the RSU or SAR require that the participant exercise the RSU or SAR at the time it vests and that the participant’s receipt of payment cannot be deferred beyond the “short term deferral” period permissible under Section 409A of the Code and the final U.S. Treasury regulations thereunder.

Parachute Payments. Under certain circumstances, an accelerated vesting or granting of Awards in connection with a Change in Control of the Company may give rise to a “excess parachute payment” for purposes of the golden parachute tax provisions of Section 280G of the Code. To the extent it is so considered, a participant may be subject to a 20% nondeductible federal excise tax and the Company may be denied an income tax deduction.

Based upon the closing price of the Common Stock as reported on the Nasdaq Global Market on March 15, 2016, the current fair market value of the Common Stock is $21.86 per share.

No Awards have been granted under the Stock Incentive Plan that are contingent upon stockholder approval of the Plan.

The summary above is qualified in its entirety by reference to the 2016 Stock Incentive Plan, a copy of which is attached as an annex to the electronic copy of this proxy statement filed with the Securities and Exchange Commission and may be accessed from the Securities and Exchange Commission’s website at www.sec.gov.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholdersshareholders vote FOR the approval and adoption of the Company’s 2016 Stock Incentive Plan.

this Proposal Two.

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors (the “Audit Committee”) has appointed RSM US LLP to serve as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.2024.

TheWhile the Company is not required to submit the ratification of the Audit Committee’s appointment of RSM US LLP as the Company’sCompany’s independent registered public accounting firm to a vote of stockholders. shareholders, the Board of Directors considers the selection of the independent registered public accounting firm to be an important matter and is therefore submitting the selection of RSM US LLP for ratification by shareholders as a matter of good corporate practice.

In the event a majority of the votes cast are against the ratification of the appointment of RSM US LLP, the Audit Committee may consider the vote and the reasons thereforetherefor in future decisions onof its appointment of the Company’s independent registered public accounting firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time if it is determined that such a change would be in the best interests of the Company.

Representatives of RSM US LLP are expected to attend the Annual Meeting, either in person or by means of remote communication, at which time they will have an opportunity to make a statement if they wish to do so and will be available to answer any appropriate questions from stockholders.shareholders.

As previously disclosed, on December 9, 2015, our Audit Committee approved

The following table sets forth the engagement of RSM US LLP to audit our financial statements as of andfees paid or accrued by the Company for the fiscal year ended December 31, 2016 to replace KPMG LLP upon completion of its audit and issuance of its related reports onprofessional services provided by the Company’s consolidated financial statements for the fiscal year ended December 31, 2015 and the effectiveness of internal control over financial reporting as of December 31, 2015.

During the fiscal years ended December 31, 2014 and 2013 and the subsequent interim period from January 1, 2015 through December 9, 2015, we did not consult RSM US LLP with respect to our financial statements, which were audited by KPMG LLP as our independent registered public accounting firm, with respect to (1) the application

of accounting principles to a specified transaction, either completed or proposed, (2) the type of audit opinion that might be rendered on our financial statements, or (3) to any matter that was the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instruction thereto) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

The audit reports on our financial statementsRSM US LLP, for the fiscal years ended December 31, 2014 and 2013 issued by KPMG LLP did not contain any adverse opinion or disclaimerindicated.

| | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | |

| Audit Fees | | $434,280 | | $402,150 | |

| Audit-Related Fees | | $29,400 | | $0 | |

| Tax Related Fees | | $42,000 | | $47,775 | |

| All Other Fees | | — | | | — | | |

| Totals | | $505,680 | | $449,925 | |

Description of opinion, nor were the reports qualified or modified as to uncertainty, audit scope or accounting principles.Fees:

During the fiscal years ended December 31, 2014 and 2013 and the subsequent interim period from January 1, 2015 through December 9, 2015, (1) there were no disagreements between us and KPMG LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG LLP, would have caused KPMG LLP to make reference thereto in its report on our financial statements for such periods, and (2) there were no reportable events (as described in Item 304(a)(1)(v) of Regulation S-K).

Audit Fees

The aggregate feesFees billed by KPMG LLP for professional services rendered for the audit of the Company’s annual consolidated financial statements forwithin the year ended December 31, 2015,Company's annual report on Form 10-K and the review of the consolidated financial statements included in the Company’s quarterly reports on Form 10-Q as filed with the SEC during the year ended December 31, 2015, and consents on SEC filings were $442,500. The same fees for the year ended December 31, 2014 were $371,500.year.

Audit-Related Fees

The audit-related fees billedFees related to the Company for the year ended December 31, 2015 were $5,000. There were no audit-related fees billedCompany’s filing of registration statements on Form S-3 related to the Company forCompany's dividend reinvestment and share purchase program, and the year ended December 31 2014.Company's shelf registration, filed on August 9, 2023.

Tax Related Fees

The Company paid $35,100 in 2015 and $34,230 in 2014 to KPMG LLP Fees billed for tax preparation services performed in each of these two years.the years indicated in the table above.

All Other Fees

No There were no additional fees were paidbilled to KPMG LLPthe Company for the years indicated in 2015 and 2014.the table above.

The Audit Committee must approve in advance any audit or permissible non-audit engagement or relationship between the Company and its independent registered public accounting firm. The Audit Committee has delegated to its chairmanchairperson this approval authority, subject to the requirement that the chairmanchairperson report the terms of any such engagement or relationship to the full Audit Committee at its next regularly scheduled meeting. All of the services described above, including those described under the headings, “Audit-Related Fees,” “Tax Related Fees,” and “All Other Fees”Fees,” were provided in conformance with such pre-approval requirements. The Audit Committee has determined that providing the services described above under the headings “Audit-Related Fees,” “Tax Related Fees,” and “All Other Fees” is compatible with maintaining the independence of KPMGRSM US LLP.

Recommendation of the Board of Directors

The Board of Directors recommends that the stockholdersshareholders vote FOR the ratification of the Audit Committee’s appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.this Proposal Three.

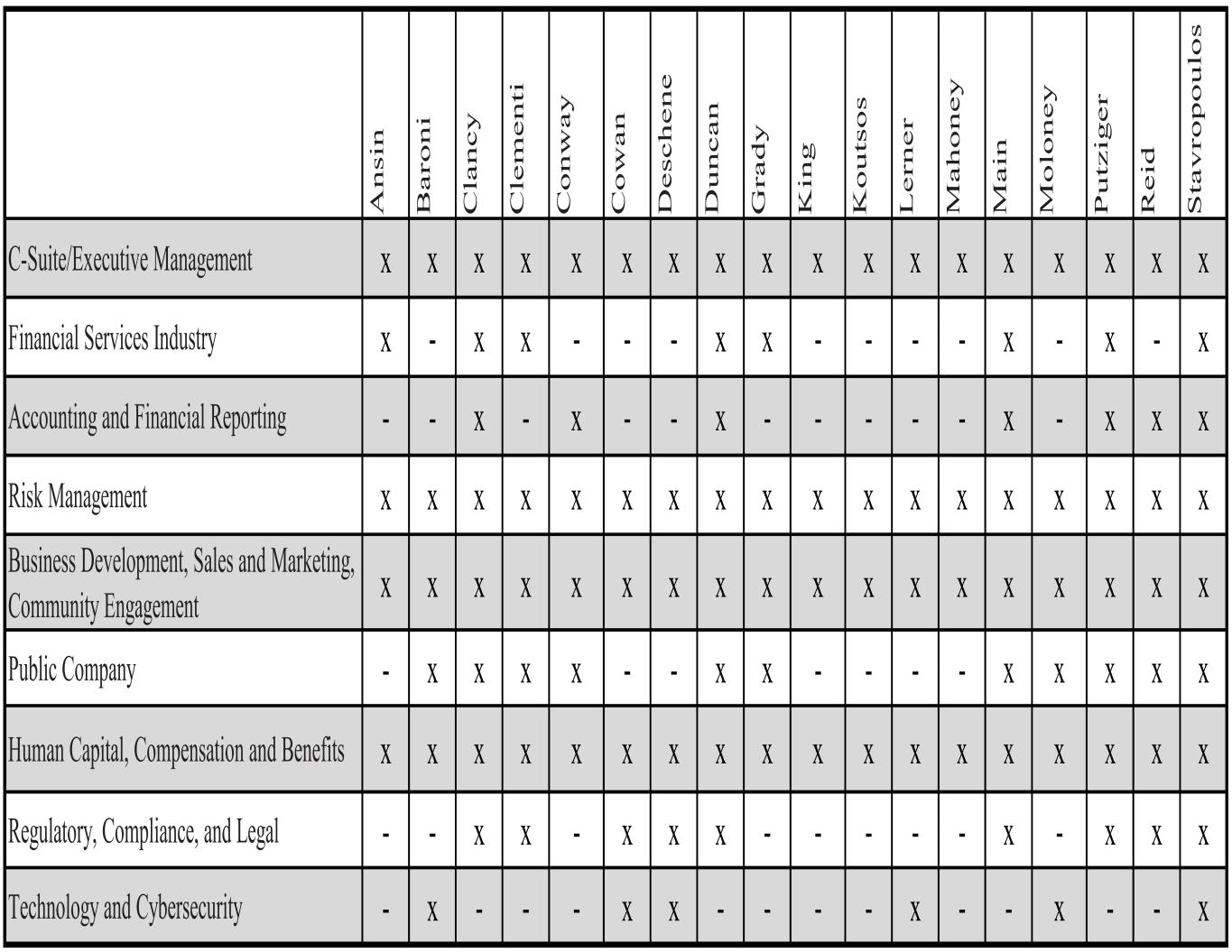

BOARD OF DIRECTORS

In addition to the nominees for election to the Board of Directors set forth under "Proposal“Proposal One - Election of Class of Directors"Directors” above, the Board of Directors is comprised of the individuals listed below whose terms expire at the annual meetings of the Company’s stockholdersshareholders in 20172025 and 2018.2026. Each individual has been engaged in his or her principal occupation for at least five years, except as otherwise indicated.

Continuing Directors

(Term to expire in 2025)

| | | | | |

| Name, Age, Principal Occupation and Qualifications | Director Since (1) |

Kenneth S. Ansin (59) President of Ansin Consulting Group, a boutique advisory firm that partners with non-profit and socially responsible businesses from various market sectors; co-founded United Material Management in 2018, which was sold to Wheelabrator/Waste Innovations in 2021; prior to July 2017, Senior Vice President, Regional Community Banking Director of the Bank; prior to August 2007, owner and President of Norwood Fine Cabinetry, a privately held company specializing in kitchen and bath cabinetry; prior to 2007, Co-founder of United Site Services Inc., today a $1 billion construction-related company. Mr. Ansin served on the boards of the Bank and the Company from 1994 - 2012 before returning in 2017.

Qualifications: Mr. Ansin’s skills as an entrepreneur, prior bank director and business owner of various companies and his knowledge of micro finance add value to the Board as they closely match the characteristics and typical financing needs of many of the Company’s commercial customers. Mr. Ansin’s knowledge of and community involvement in Nashoba Valley Massachusetts, North Central Massachusetts and Lexington, Massachusetts provides valuable market knowledge and contacts within the Bank’s market areas. | 2017 |

| |

| |

George L. Duncan (83) Executive Chairman of the Company and the Bank since their inception; prior to 2007, also Chief Executive Officer of the Company and the Bank.

Qualifications: Mr. Duncan’s sixty plus years of experience with financial institutions and commercial lending provides the Board with expansive knowledge relating to credit risk, loan portfolio management and bank management in varying market conditions. Mr. Duncan’s role as Executive Chairman and past Chief Executive Officer of the Company, along with his past tenure as chief executive officer of an earlier Greater Lowell-based independent commercial bank prior to his founding of the Bank and leadership positions at many local, community non-profit organizations, also provide valuable industry specific and local community experience, market knowledge and contacts. | 1988 |

| |

| |

| |

| | | | | |

| Name, Age, Principal Occupation and Qualifications | Director Since (1) |

Jacqueline F. Moloney (70) Professor and Chancellor Emerita, University of Massachusetts - Lowell; prior to May 2022, Chancellor, University of Massachusetts - Lowell; since June 2016 Director of MKS Instruments, Inc., a technology solutions provider; prior to August 2015, Executive Vice Chancellor, University of Massachusetts - Lowell.

| 2010 |

Qualifications: Dr. Moloney’s experience with leadership, budgeting, governance, strategic planning, marketing, education, technology, sustainability, diversity, and innovation adds value to the operating committees of the Board and enhances the Board’s overall understanding of the Bank’s operating environment and internal control structure. Dr. Moloney has previously served as a bank director and has served on numerous civic boards throughout the Merrimack Valley. She provides valuable knowledge and insight to the Board on emerging industries and business trends within the Bank’s market area, as well as local developments affecting the Greater Lowell community. | |

| |

Michael T. Putziger (78) Since 2009, Chairman of WinnCompanies, a private real estate company that develops, acquires and manages multi-family and mixed income properties nationwide; prior to January 2016, Partner and Of Counsel to Murtha Cullina, LLP, a law firm that provides legal services to businesses, government units, non-profit organizations and individuals.

Qualifications: Mr. Putziger’s legal experience and familiarity with commercial real estate development, financial institutions, banking industry trends and public markets provide value to all aspects of the Board’s decision-making process.Mr. Putziger’s service as chairman of a publicly traded, multi-bank holding company and as a director of a publicly traded thrift holding company and its subsidiary federal savings bank also provides him with substantial experience in the banking and thrift industries and with respect to relevant industry activities and challenges.This experience has been of value to the Board in, among other areas, its oversight of the Company’s wealth management services. governance, commercial and construction lending, strategic planning, and its consideration of various capital raising alternatives for the Company.Mr. Putziger possesses the qualifications necessary to be designated an “audit committee financial expert” under applicable SEC rules. | 2008 |

| |

Carol L. Reid (76) Former Financial Executive; prior to September 2005, Vice President, Corporate Controller and Chief Accounting Officer of Avid Technology, Inc., a publicly held company specializing in digital media creation tools for film, audio, animation, games and broadcast.